[ad_1]

[ad_1]

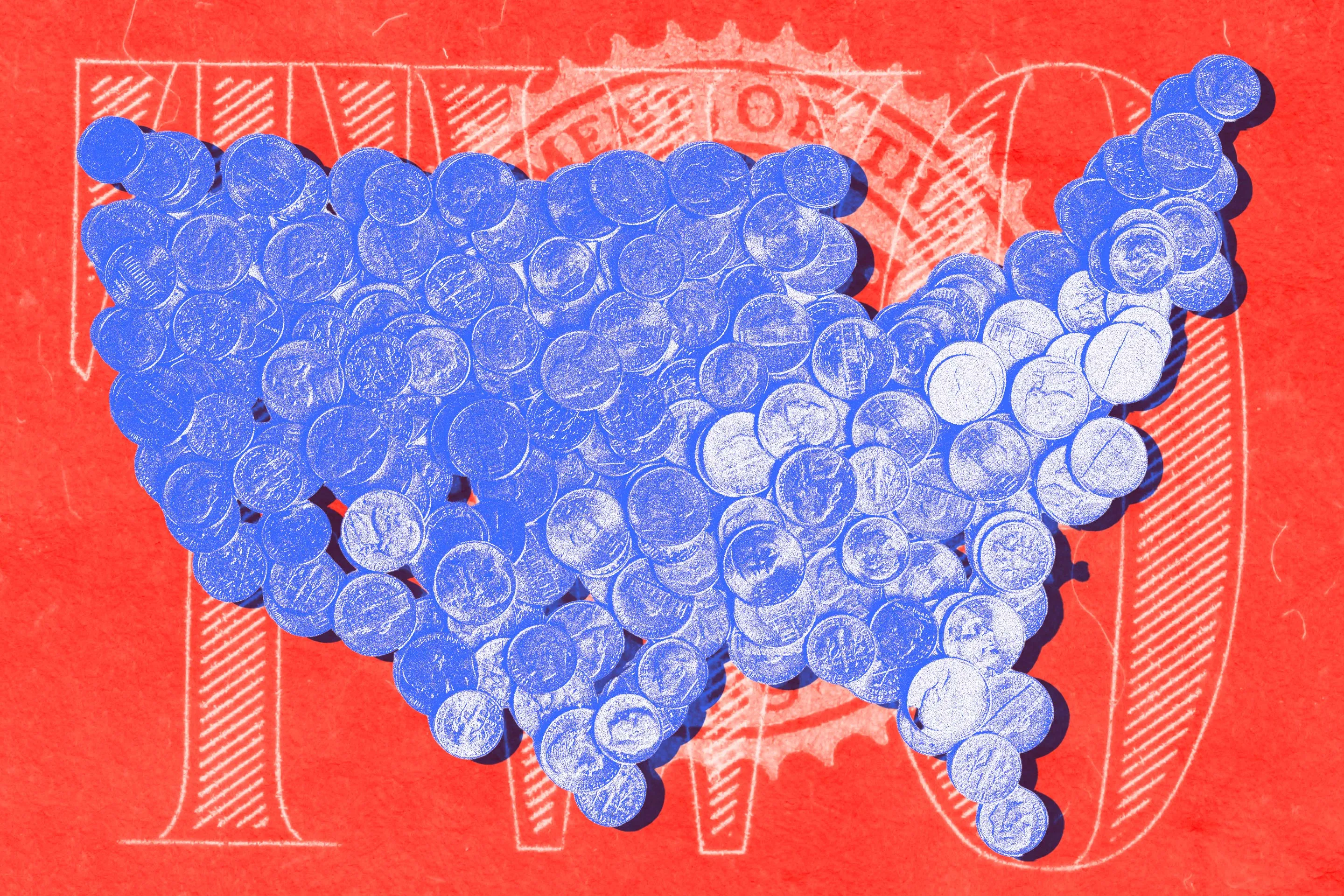

The tax returns hundreds of thousands of Individuals are submitting this spring could convey a uncommon bit of excellent information. Most states once more took in extra money in taxes than they forecast final yr, and lots of of them are passing alongside a bit of these surpluses within the type of tax cuts and credit for 2023.

In keeping with the Nationwide Affiliation of State Funds Officers, 46 states ended the 2023 fiscal yr with a funds surplus. The black ink continues a development: That is the third consecutive yr during which most states exceeded income projections, due partially to pandemic stimulus funds to states and booming state economies. About 80% of states have handed some type of earnings tax break since 2021, in line with the Related Press.

Some states deepened these charge cuts in 2023 and 2024, if modestly. And a handful of them are utilizing their bounty to ship tax credits, largely to lower-income households with youngsters.

Take into account that since state taxes are usually decrease than federal ones, adjustments not often add — or subtract — as a lot to your tax backside line as do changes to the federal tax code. That mentioned, relying on the place you reside and what you make, these adjustments could lead on you to pay a whole lot — even perhaps hundreds — much less to your state in earnings tax this spring.

States with new or expanded youngster tax credit

Probably the most impactful adjustments in state taxes this yr have come within the type of new or expanded tax credit focused at households with youngsters, in line with Aidan Davis, state coverage director on the Institute of Taxation and Financial Coverage (ITEP), a nonprofit, nonpartisan tax coverage group.

“The first really incredible — and, I would say, positive — trend was that 18 states created or enhanced child tax credits or income tax credits in their states,” Davis says. Three of these states (Minnesota, Oregon and Utah) launched brand-new youngster tax credit, she says, with the rest altering, and often bettering, present credit.

In keeping with ITEP’s rundown of the adjustments, states that tweaked youngster tax credit embody New York, New Jersey, Colorado, Maine, Maryland and Vermont. Arizona lawmakers created a one-time youngster tax rebate.

Unsurprisingly, the scale of those 2023 credit range by state and earnings. They sometimes vary between $200 to $1,000 per youngster, relying on earnings. Minnesota’s new credit score presents probably the most — as much as $1,750 per youngster.

As a rule, the least-wealthy households qualify for the utmost credit score, and the wealthiest could obtain little or none of it. Solely Minnesota households that make lower than $30,000 or so get the complete quantity, for instance, and Oregon’s program is focused solely at households in that earnings vary. In different states, the profit is clawed again at greater earnings ranges — as it's for households who make between $125,000 and $165,000 in Vermont, after which the credit score phases out totally.

Tax breaks for residents with youngsters dominated the state earnings tax adjustments in 2023, however there have been additionally adjustments to the tax exemptions given to older adults in a minimum of one state: Michigan. ITEP stories that the Wolverine State’s retirement earnings subsidies, which have been pared again over a decade in the past, have been reinstated below state laws signed in 2023.

States with earnings tax cuts

In 2021 and 2022, the primary years during which the vast majority of states ran pandemic-era surpluses, a tsunami of cuts have been made to state tax charges. They largely stay in place now. However a minimum of 5 states made additional reductions in 2023, usually by decreasing many or all state tax charges by just a few tenths of a p.c.

Because of this, state taxpayers in Utah, West Virginia, North Dakota and Arkansas may even see a barely smaller state tax invoice on their 2023 returns, in line with a tally by the Tax Basis, one other nonprofit, nonpartisan tax institute. These cuts — made by Republican-controlled legislatures — are across-the-board reductions that have an effect on all state taxpayers. Consequently, Davis says, the adjustments will ship greater advantages in actual phrases to residents within the highest tax brackets.

Trying forward, quite a few states have already handed 2024 cuts that kicked in on Jan. 1 — or will on July 1 — and can have an effect on tax liabilities when taxpayers file their returns subsequent yr.

Michigan is one exception to that rule. In a current courtroom choice, the Michigan Court docket of Appeals deemed the state’s 2023 tax cuts to be solely momentary and allowed Democratic Governor Gretchen Whitmer to roll again the change, which she had deemed to be overly tilted in direction of reduction for the wealthiest Michiganders.

In any other case, a lot of the state tax adjustments taking impact this yr are additional across-the-board reductions in crimson states. In keeping with the Tax Institute, these embody Arkansas, Indiana, Iowa, Kentucky, Mississippi, Missouri, Nebraska, North Carolina and South Carolina. Two states — Ohio and Montana — will consolidate some tax brackets, and one state, Georgia, will transfer to a flat tax.

There’s concern from teams like ITEC that continued income-tax cuts in 2024 and past, although welcomed by some taxpayers, will more and more start to set off penalties that many could not need. State surpluses are anticipated to be decrease, and even reverse, this yr, in line with projections from the Nationwide Affiliation of State Funds Officers.

Davis says she fears the detrimental outcomes of that crunch might embody continued cuts to public companies, resembling training, or the imposition of upper taxes on consumption and properties: regressive taxes that “will widen the gap between rich and poor state residents,” she provides.

Extra from Cash

When Are State Taxes Due? Here Are the 2024 Deadlines