[ad_1]

[ad_1]

To the typical individual, a hedge fund supervisor is probably the primary picture that involves thoughts when pondering of a quintessential Wall Avenue character: a suited guru shouting orders into the cellphone, brokering trades that make their clientele wealthy. However just lately, actuality paints a unique image. After a subpar yr in 2023, portfolio managers have been compelled to shift methods, with many turning to vanilla index funds to make up for poor efficiency.

Final yr was a bounce again for the broader market after a dismal 2022, nevertheless it was nonetheless not form to hedge fund traders, who anticipate their cash managers to provide returns that beat the market averages. Based on recent survey data from banking firm BNP Paribas, hedge funds noticed a return of 6.67% globally all through 2023, 1.5% shy of their meant goal price. Comparatively, the S&P 500 produced a 24% return final yr, permitting traders who embraced the easy technique of investing in index funds to expertise comparable positive aspects.

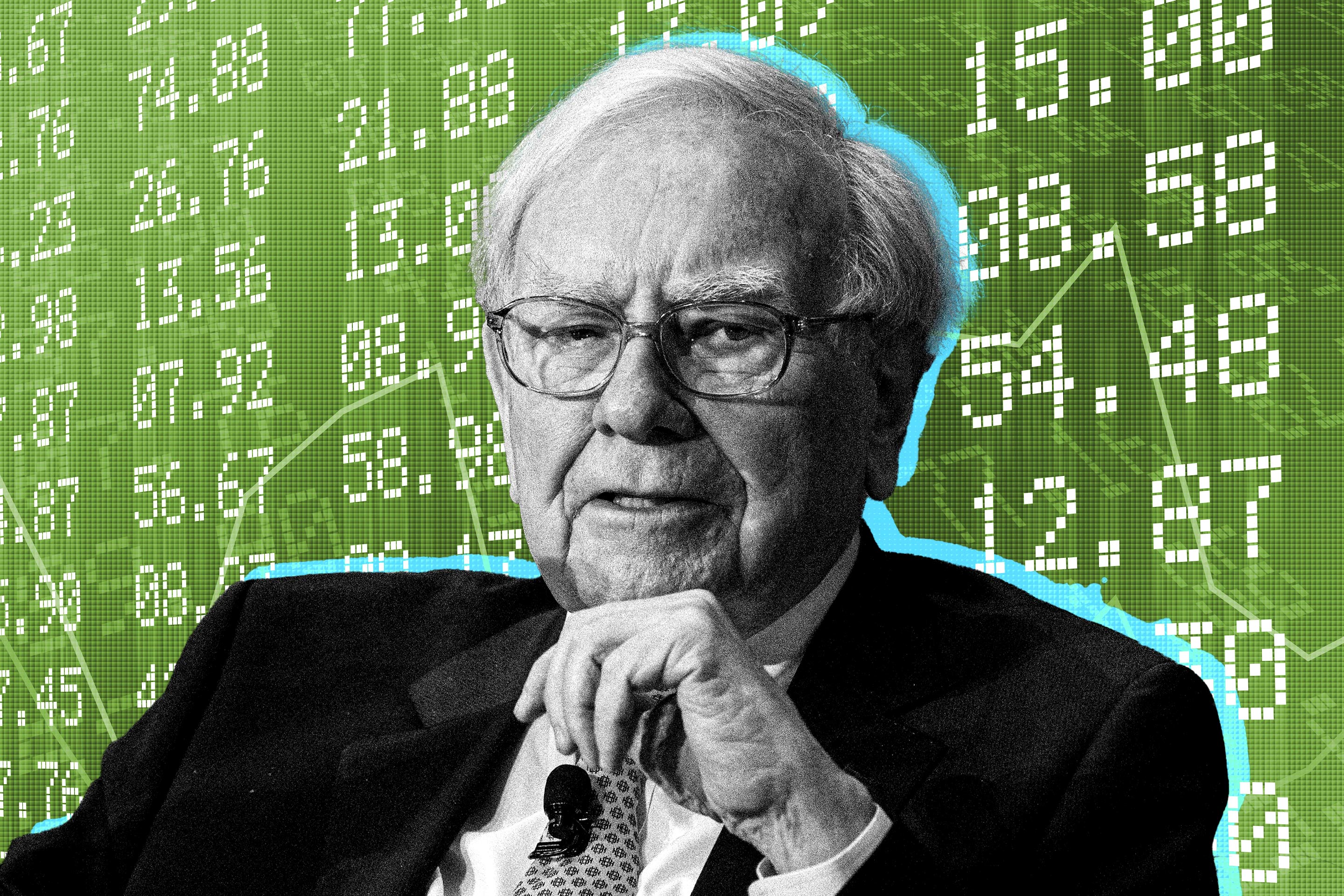

Because of this, a lot of these hedge funds are altering their approaches and investing in index funds, that are being pushed by the continued success of enormous cap shares. The development exemplifies why many retail traders heed the long-touted adage of Warren Buffett: Index funds are one of the simplest ways for an investor to get inventory market publicity. Hedge funds, it seems, are taking discover, too.

It may not appear stunning that a portfolio supervisor turns to an funding that makes cash — that is their job. However hedge funds do not usually dip into index funds. With their excessive charges, and thus excessive internet value traders, these funds are usually concerned in additional sophisticated methods meant to beat the index funds that they are now shopping for. This rising reliance on index investing is a transparent signal that hedge funds are greedy for a life preserver.

Hedge funds are investing like index funds

Whatever the state of the market, the first objective of a hedge fund is to ship optimistic returns to their usually high-net-worth shoppers. Nonetheless, in 2023, these returns fell nicely wanting what traders and fund managers hoped for, whilst the foremost indices rebounded from 2022's bear market.

Among the world’s largest and most respected hedge funds, like Citadel’s Wellington fund or Sculptor’s Och-Ziff fund, noticed returns in 2023 of 15.3% and 12.9%, respectively. Whereas spectacular in comparison with the combination, these funds sorely underperformed when in comparison with the S&P 500 or the tech-heavy Nasdaq-100, which returned an eye-popping 55% throughout the identical time.

A method these hedge funds had been capable of rebound, although nonetheless falling wanting expectations, was by means of “index hugging” — when an actively-managed fund (like a hedge fund) invests extra like an index so as to enhance its returns.

Knowledge from Goldman Sachs’ Hedge Fund Pattern Monitor reveals that hedge funds are narrowing their underperformance to index funds by shifting their portfolio weighting far more closely towards development shares, such because the “Magnificent 7” tech shares that characterize the biggest holdings in lots of index-weighted portfolios. Of the greater than 700 hedge funds analyzed, practically one in seven have Amazon, Microsoft and Meta amongst their 10 largest holdings.

Taking Warren Buffett's recommendation

Warren Buffett is well-known for his opinion that the typical investor can buy and proceed to build up investments in index funds. In 2020, Buffett stated that “for most people, the best thing to do is to own the S&P 500 index fund, adding “People will try to sell you other things because there's more money in it for them if they do.”

This no-frills funding technique is likely one of the finest for guaranteeing long-term, low-cost positive aspects. Nonetheless, Buffett’s recommendation will not be essentially meant for hedge funds however particular person traders. In actual fact, there are a number of issues which come up from hedge funds hugging indexes for returns fairly than pursuing alpha (positive aspects in extra of market benchmarks). Considered one of these is that many hedge funds look nearly indistinguishable from each other as they crowd into the identical positions. This might have big implications if the market had been to shift for the more severe and people funds had been to behave rashly in unison.

One other subject is that traders in these hedge funds are usually not getting the companies they're paying for. Hedge funds usually require lofty service charges from their shoppers — usually a administration payment of two% of the fund's internet asset worth and a efficiency payment of 20% of the fund's income along with a minimal funding that usually begins at $100,000 however can vary north of $1 million. These funds make hedge funds much less accessible for common traders, but when funds are merely shopping for and holding what index funds are holding, then the individuals invested in them are paying way more for one thing that also underperforms the very indices they're attempting to mimic.

Whether or not hedge funds will have the ability to meet their overperformance expectations for 2024 will likely be a matter of paring down on mega-cap investments and pivoting towards extra dynamic methods. However the large takeaway for the on a regular basis investor is that Buffett’s recommendation nonetheless rings true in 2024; index funds present one of many least expensive and most confirmed methods to take a position for long-term development. Even the flamboyant hedge fund managers on Wall Avenue are embracing this idea, although they might be quiet about it.

Extra from Cash:

How Investors Can Gain Exposure to 2024's Hottest Stock

Finance Giants Say 2024 Will Favor Active Investing Over Safer Passive Approaches