[ad_1]

[ad_1]

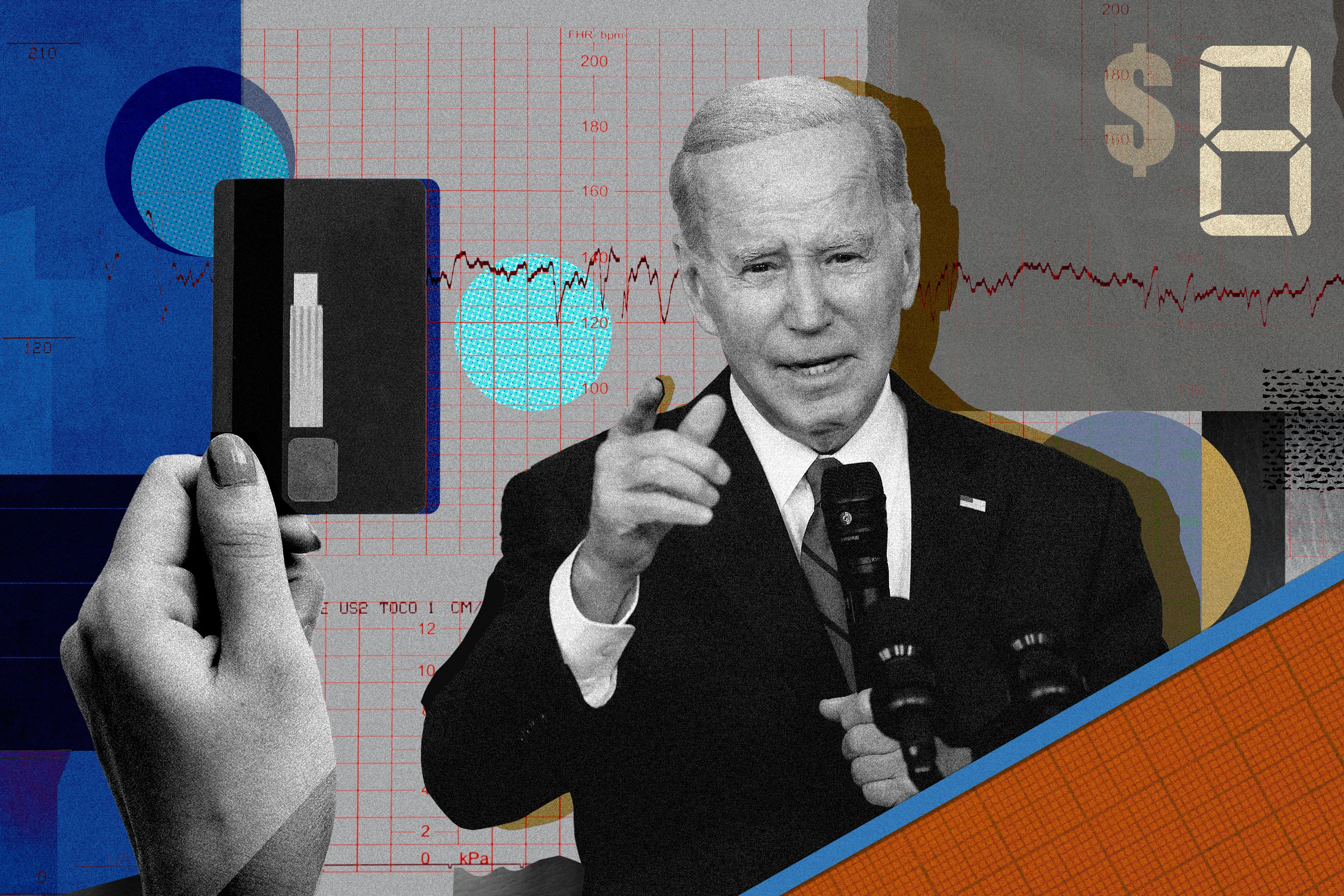

President Joe Biden desires to rein in what his administration sees as extreme late charges charged by bank card corporations. Biden is saying a brand new rule on Wednesday that may decrease bank card charges to $8 for a late cost, down from the present $41 restrict.

Why it issues

Individuals are charged about $12 billion annually in bank card late charges, in keeping with the Client Monetary Safety Bureau (CFPB), a federal watchdog company. The charges range by issuer, however sometimes are the equal of the minimal month-to-month cost quantity for the primary missed cost — as much as a max of $30 — and as much as $41 for subsequent missed funds. The CFPB is the federal government physique in control of proposing the brand new rule, which might not require Congressional approval.

- The CFPB estimates the rule would cut back late charges charged to bank card holders by upwards of $9 billion per yr.

- The company is gathering public touch upon the proposal, and the small print might change based mostly on the feedback it receives.

- The rule might go into impact as early as 2024.

CFPB Director Rohit Chopra outlined the brand new rule to reporters on a name Tuesday, forward of Biden’s announcement.

“By our estimates, 75% of late charges — $9 billion — haven't any objective past padding the bank card corporations’ earnings,” Chopra mentioned on the press name.

Key context

The CFPB says this new rule is an effort to shut a loophole within the 2009 Credit score Card Accountability Accountability and Disclosure (CARD) Act, which was handed by Congress to, partly, improve disclosures and restrict charges for shoppers.

- Nonetheless, after its passage, the Federal Reserve added an “immunity provision” on sure charges just like the late cost charge, permitting bank card corporations to cost what the CFPB now sees as unreasonably excessive late charges.

- The present cap to those particular late charges which might be immune from the CARD Act rise yearly based mostly on inflation. The CFPB additionally desires to finish that provision.

"We discovered that, over time, this loophole has morphed right into a multi-billion greenback bonanza," Chopra mentioned.

The brand new proposal is the newest effort from the Biden administration to curb what it calls “junk charges.”

Different junk charges within the Biden administration’s sights embrace charges for overdrafts, non-sufficient funds and bounced checks in addition to different charges levied by telephone service suppliers, motels and airways.

Extra from Cash:

6 Greatest Credit score Playing cards of February 2023

9 Greatest Money Again Credit score Playing cards of February 2023

Why Clients Say American Categorical Is Their Favourite Credit score Card Firm

Supply https://classifiedsmarketing.com/?p=33614&feed_id=123626